Water Backup Condo Insurance

Additional coverage for expensive jewelry and keepsakes.

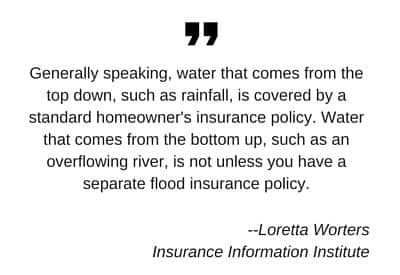

Water backup condo insurance. It may not cover sewer or drain backups or flooding which would require additional coverages or policies. Sometimes referred to as sewer backup insurance water backup insurance must be purchased as a special addition to your standard insurance policy. It offers coverage in varying amounts that extends to damage done by raw sewage backing up into your home. The unit owner s insurance policy is meant to cover the cost of personal belongings and interior repairs.

Count on quality coverage. Without the endorsement you would be stuck paying for the cost of cleanup or damages caused by a sump sump pump or similar equipment that s not considered a plumbing system or household appliance. Since water backups are such a common and pesky problem just about every company offers this coverage enhancement and it s a fairly high value add on costing as little as 30 a year on top of your standard coverage. Homeowners insurance does not typically cover water backup damage.

Overflow or back up of the drainage systems in your home. This type of water damage typically isn t covered by your building s master policy your condo policy or flood insurance. Insures your property against water damage that results from sewer or drain backups. The average cost of water backup and sewer coverage may range from 50 to 250 per year with limits of coverage from 5 000 to the full replacement cost of your home.

Water backup coverage is an optional endorsement that must be added onto a standard homeowners condo or renters insurance policy. Determining who is liable for condo water damage can be a tricky task as it depends on the precise cause of the damage. For instance it may help cover the cost of replacing furniture or removing water after an unexpected backup. Sewer backup is not automatically included in most standard homeowner policies.

What is water backup insurance. Talk to your independent insurance agent to find the level. This coverage may help pay for water damage resulting from a backed up drain or sump pump. Water backup coverage also called sewer or sump pump backup coverage is one of the more popular and useful homeowners insurance endorsements that you can add to your policy.

Water backup and sump pump overflow coverage is an optional coverage that must be added on to a homeowners policy. If your gutter systems or rainwater pipes are blocked or overwhelmed by debris or sudden water flow it may cause a back up into your home. How much does water backup coverage cost. One of the reasons why a condo association carries insurance is to cover loss from unexpected events such as a sewage backup.

Water backup coverage is an optional add on to a homeowners insurance policy.