Ice Cotton Futures Historical Prices

Unfixed call sales change from previous week unfixed call purchases change from previous week at close 08 21 2020 change from previous week.

Ice cotton futures historical prices. That net long position of 53 231 contracts was the largest since sept 2018. Free intra day cotton 2 futures prices cotton 2 quotes. Furthermore you acknowledge that you have read and agree to all terms presented in the following document. 0 0 0 0 114 11 december 2020.

Closing price open high low change and change of the us cotton 2 futures for the selected range of dates. Cotton futures finished the week on a strong note with most front months excluding thin oct up 69 to 83 points. The current price of cotton as of september 04 2020 is 0 6412 per pound. 38 074 229 22 075 402 110 039 3 500 march 2021.

Call cotton based new york. Miso indiana hub day ahead peak fixed price future. In addition to continuous charts the collection includes thousands of single contract historical price charts that cover individual contract months from years past. Cotton prices 45 year historical chart.

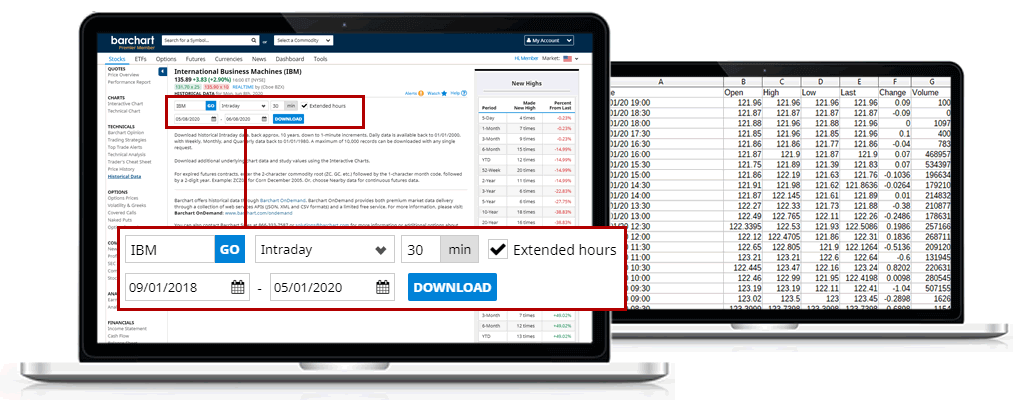

Us cotton 2 futures historical prices. Interactive chart of historical daily cotton prices back to 1969. Friday s commitment of traders report indicated that specs added 4 508 contracts to their net long position in cotton futures and options as of september 1. Contracts use the following methodology to allow long term price comparisons.

Medium long term interest rates. Ice us c1 cotton no2 futures chain price information historical data charts stats and more. The market data and information contained herein constitutes confidential information and valuable property owned by ice data services its affiliates licensors and or other relevant third parties. Low sulphur gasoil futures.

Current and historical prices chart and data for the ice cotton futures 1 ct1 contract. This continuous historical price chart for cotton 2 futures ct ice futures is part of a huge collection of historical charts that covers decades of north america futures commodity trading. Front month calendar weighted adjusted prices roll on first of month continuous contract history. Ice report center terms and conditions.

Crude oil and refined products.